Some Of How Does Medigap Works

Table of ContentsThe Buzz on Medigap BenefitsMedigap Benefits Fundamentals ExplainedFacts About What Is Medigap RevealedAbout MedigapSome Known Details About What Is Medigap

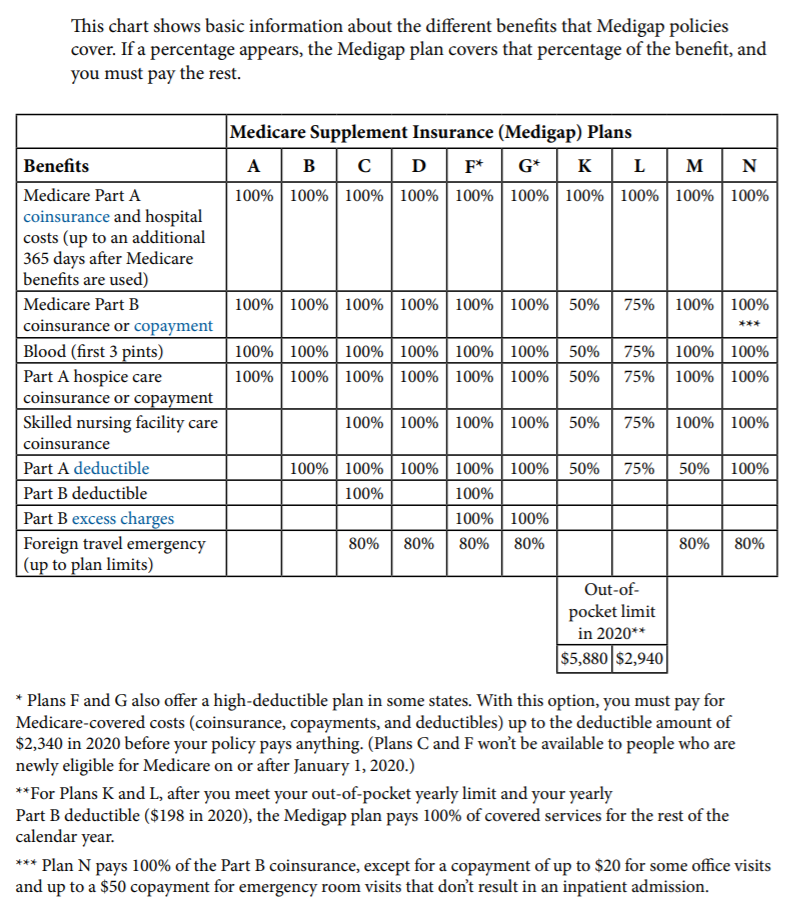

For example, a plan could cover just 75% instead of 100% of the Medicare Part A deductible. Depending on your revenue degree, the state Medicaid program might pay component or all of your Medicare Part B costs, and possibly various other costs too. If you have Medicare Component D, Roland suggests getting Bonus Assistance, a government subsidy with payment help for Part D costs, deductibles and co-insurance.You might hear it called different names, they are the exact same thing. Medigap or Medicare Supplement insurance job to cover any scarcities or "gaps" that Original Medicare (Components An as well as B) does not spend for. Medigap insurance coverage is marketed by personal insurance provider. By regulation, business can just offer typical Medigap insurance coverage strategies.

Plans An as well as B do not use coinsurance for skilled nursing facility care, but the other plans do supply help.

We're on a mission, serving with enthusiasm, function and a smile!

The 5-Second Trick For What Is Medigap

To determine the right fit, it is very important to understand what makes these insurance coverage choices various. It truly relies on your requirements, and each kind of strategy can have benefits and drawbacks. To begin, focus on what you're really seeking, including out-of-pocket prices, prescription drug protection, fringe benefits as well as even more.

Fringe benefits: Several plans use insurance coverage for vision, dental, hearing as well as even more. Network option: For the most affordable prices, you need to see medical professionals as well as healthcare carriers who are a part of the strategy's network. The majority of plans will certainly offer some kind of out-of-network protection, also yet it might have higher cost-sharing.

Medigap Benefits Can Be Fun For Everyone

Depending on your monetary scenario and also your healthcare requirements, the strategy that functions best for you may alter gradually yet registering in either a Medicare Advantage or Medicare Supplement strategy can aid with prices not covered by Initial Medicare.

Medicare Select is a sort of Medigap plan that requires insureds to use particular healthcare facilities and also in many cases specific doctors (other than in an emergency situation) in order to be qualified for complete advantages. Apart from the limitation on hospitals and carriers, Medicare Select policies have to satisfy all the demands that relate to a Medigap policy.

When you utilize the Medicare Select network medical facilities as well as companies, Medicare pays its share of authorized fees and the insurer is in charge of all supplementary advantages in the Medicare Select policy. As a whole, Medicare Select plans are not needed to pay any type of benefits if you do not use a network service provider for non-emergency services.

The Medigap payment alternatives might vary depending on the insurance policy business, but right here are some typical methods to pay your Medigap costs:: You can set up automated repayments from your bank account so that your Medigap costs is automatically subtracted each month.

The Single Strategy To Use For Medigap Benefits

You will not even see the costs yet you may receive an "explanation of payment" that reveals who paid what. If your Medigap strategy does not cover the Part B deductible as well as you have not yet fulfilled your insurance deductible for the year, you will require to pay that quantity prior to your Medigap policy will certainly start covering expenses.

If, not you can contact your representative or the insurance policy service provider directly.

While Medicare Component An as well as Part B advantages originate from the federal government, Medicare Supplemental plans have actually advantages provided by private insurance service providers. These providers costs Medicare first and bill the remaining quantity to the Medigap provider. In 47 states, Medigap plans are determined by letters A via N. Each lettered strategy offers a various protection degree.

Furthermore, it is vital to keep in mind that if you have a Medicare Supplement policy and also your spouse needs insurance coverage, they should acquire a separate policy. Usually, Medicare Supplement plans offer specific protection, so you and also your partner can not share a policy. Nevertheless, not having the ability to share a policy provides extra positives than negatives for spouses.

Indicators on Medigap Benefits You Need To Know

Ronald and Carolyn are a married couple turning 65 as well medigap as enrolling in Medicare. When registering in a Medicare Supplement strategy, Ronald wants something affordable to cover him in an emergency situation.

When you register in a Medicare Supplement strategy throughout this time, you have actually guaranteed issue legal rights. You may still enlist in Medicare Supplements outside your Medigap Open Registration Duration window, but you may be subject to health and wellness concerns.